As some countries, especially in the EU, have different tax-classes for different type of products, we want to show you, how you can enable different tax-classes per product using the commerce eu-vat module (and disabling the currently used commerce_tax module).

Here we go.

1. Disable commerce_tax

Out with the old... since we want to use the "commerce_eu_vat" module there is no need for the "commerce_tax" module,

that ERPAL platform uses by default. therefore you can disable it, preferably by using drush:

$ drush dis -y commerce_tax.

2. Enable commerce_eu_vat

You can either download the module, put it into the designed folder (sites/all/modules/contrib) and enable it in the

modules section of your ERPAL installation, or - as we all love drush - you can do it all in just one command:

$ drush en -y commerce_eu_vat commerce_eu_vat_<country-shortname>

You just have to replace the <country-shortname> with the shortname of your choice e.g. commerce_eu_vat_at for

austrian taxes or commerce_eu_vat_pl for the polish and so on.

If you are not sure which is the correct shortname, just use $ drush en -y commerce_eu_vat and check the modules

page, there you can find the full country names to each available module.

3. Patching commerce_vat

The commerce_vat module is a dependency of the new commerce_eu_vat, but it (currently) needs a little fix to work as we want it to. Luckily the right patch is available and applying it is not a big thing to do.

See the issue details for more information about what the patch does: https://www.drupal.org/node/2366943

Patching may sound a bit scary at first, but it's actually just two steps:

- download the patch-file and put it into the root-directory of the commerce_vat module

- navigate to the commerce_vat folder and apply the patch with this command:

$ patch -p1 < commerce_vat--rebase-price.patch

For more details on how to apply patches have a look at https://www.drupal.org/patch/apply when you are using git or https://www.drupal.org/node/534548 if you want to apply a patch manually.

Done? You're Awesome.

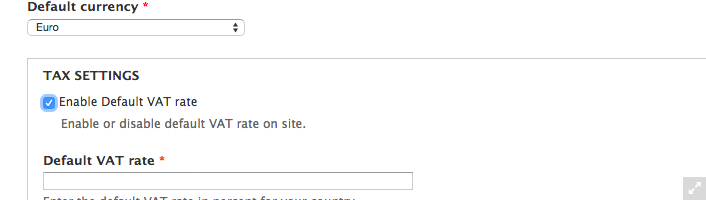

4. Disable the default vat-system

Next: navigate to ERPAL » ERPAL Settings » "Vendor settings" (/admin/erpal/settings/vendor) and disable the checkbox for "Enable Default VAT rate" - this will now be handled by the commerce eu-vat module.

5. Clear cache

Important step, without clearing the cache you would not see much of a change. So again: drush to the rescue $ drush cc all.

Finish!

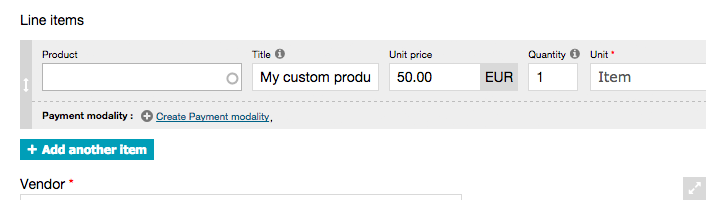

And that's it already. Now you should be able to select the appropriate tax-class for your new or existing products - it should look something like this while editing a product:

One more thing: Custom products

As disabling commerce_tax also disabled the use of a global tax-rate, there will be no tax applied to "custom products".

What is a custom product?

Good question! While creating a quote, order or invoice you can add "custom products", line-items that do not reference an existing product (aka leave the product field blank).

Why is that happening?

The eu_vat system stores the tax information on the products, not on the line items. So if you don't reference a product, there is no information on which tax rate to apply.

Any solution to this?

If you need custom products, it would for example be possible to add an extra field to the product line item to allow entering a tax rate. Then you could add rules that check if the line item does not reference a product. If so, check for and use the tax rate field.